#GST NOTIFICATION

Explore tagged Tumblr posts

Text

Impact Of New GST RCM Provision On GST Registered Persons

What is The New GST RCM Provision?FAQs On New ProvisionConclusionYou May Also LikeGet Free Updates[Join WhatsApp Group] What is The New GST RCM Provision? The Government has introduced new GST RCM provision on payment of rent (for any property other then residential dwelling) by GST registered person to unregistered person vide Notification No. 09/2024- Central Tax (Rate) on October 8,…

0 notes

Text

Jaw is swelling up now but probs cause i was moving around and squattng a bunch. Up at my almost 90 degree angle to sleep so maybe itll go down i am tired though now augh

#wait i didnt check if shimeji uploaded. i didnt get a notif though#someone on the reddit did confirm last chapter </3 i was hoping 'next: finale' would be like a two parter. oh well#a nicr place to end off methinks. we will see#nomatter what its still going to remain a favorite of mine :) i will read girls last tour soon though ofc i need to gst on that#ayways smiles :)

2 notes

·

View notes

Text

The Dispute over GST Application in Development Rights Transfer: Insights from Telangana High Court

The Telangana High Court recently witnessed a significant dispute revolving around the application of Goods and Services Tax (GST) to the transfer of development rights in property ownership. This dispute centered on the interpretation of clauses within Joint Development Agreements (JDAs), crucial documents governing the relationship between landowners and developers. Delving into the provisions…

View On WordPress

#constitutional concerns#development rights transfer#gst#GST dispute#GST notification challenge#JDA interpretation#Joint Development Agreement#law-firm-internship#legal standing#news-updated-knowledge-information#real-estate#regulatory intricacies#Supreme Court precedents#tax#tax implications#Telangana High Court

0 notes

Note

just saw your patreon tax post, but what is bad about kofi membership? I got confuse after seeing comments arguining about which platform is better, and you also talked about kofi a bit...

I wish I can make a patreon but I got nothing but my writings, which barely get any attention

[context]

Okay I should've phrased it correctly, it's less about which platform is better than the other, but rather which platform is more suited for you. I know you're more on writing, but I'll offer a general view since I've used both sites + others has asked me about this. Disclaimer, these are all from my personal experience, it can be different to the rest.

What both of them can do:

Offer tier membership, you can offer free or paid and list down the benefits of joining your membership, you can also limit how many members you want.

Basic build in functions such as posting photo and poll.

Digital and physical benefits.

Analytics and tracking management.

Discord integration.

Financial payouts such as PayPal, Stripe or Cards.

Ko-fi membership

The Good

Generalized service for smaller scale projects, such as a tipping site and paywalled subscription service for fewer fees than patreon (ko-fi takes 5%).

Good for beginners because there are a lot of things that can be performed with a simple button, with comprehensive FAQ lists. Extremely straightforward with zero hastle.

Payment goes directly into your digital (PayPal/Stripe) or physical (card) wallet, no waiting for payout days.

The Bad

No NSFW content, if you try to go around this rule high chance to get penalized and your account goes bye bye. I've seen artists who offer nsfw art commissions in a hush hush way, but guess what? Ko-fi monitors your dms apparently, so if you sent nsfw related content through DMs or Posts, you're very likely going to get banned (happened to a friend).

There's no mobile app, might be a hastle if you want to post and handle things, every notification or changes you'll have to do it on web or desktop/laptop.

No direct video uploads, you'll have to use a link (a disadvantage if you're offering timelapse videos or podcasts)

For discord integration, it's finicky, half the time it doesn't work. This is due to pledger needing to connect their discord to their profile first before joining yours.

Sales tax are not automated. I may be incorrect here so better refer the FAQ, but from what I am understanding is that kofi doesn't automatically calculate, collect and remit sales/VAT/GST tax based on the buyer's location, content sold and local tax laws. You need to manually add them yourself. If you're charging $10, the buyer pays exactly $10, you receive <$10. If your country requires you to collect VAT or other sales tax, you're responsible for calculating how much should go to taxes, reporting and possibly remitting that amount manually or issuing any tax-compliant invoices if required. Uhhh so far I have not seen any cases regarding taxes, so I'm basing this off their FAQ page, posts online and youtube.

No group dms, so if you're someone who prefers to have more engagements with your supporters such as wanting to update things through chats, asking feedbacks, or simply just vibing with them, it might feel limited on Ko-fi. This is why most people have a separate discord group for better handling and posting in general.

Limited management. There are lesser details on post views, membership management, tracking payment or managing your posts. Every post you share in Ko-fi goes directly in your gallery which, in my opinion, kinda sucks because it's cluttery and messy. You will just have a tab of payment, like who joined, who has outstanding payment and who left.

Patreon

The Good

Bigger popularity and attention since it has been a thing for years. Also famously known as "pay so you can see art of dicks, tits and balls" site. Although throughout the years they've been trying to suppress NSFW posting for some reason (it is still allowed, just with some bullshit rules to deal with).

Mobile apps available, simple to use and comfortable to handle everything anywhere any time.

You can upload videos directly. You can also do polls, audio, link and livestreams.

Detailed analytics. Posts impressions/views, membership earnings, surveys (what your patreon members are joining your membership for), traffic (total visit of your patreon page and where they're coming from). This is especially useful when you have a massive following and want to have insights and control over your performance (or if you just wanna be nosy like me KAJSDKF).

Buttload of other functions that I myself have not learn much, such as automated promotions, discounts and product selling.

Built-in Discord integration. Uhm idk if Patreon works better than Ko-fi cuz when I transition to Patreon I didnt set up a discord group like before (I don't have the commitment to run and maintain them)

(Again as previously mentioned, fact check on their official page instead because I'm not sure about this) Sales tax automatically calculated and added. Patreon automatically adds VAT or applicable taxes on top of what supporter pays. If you're charging $5, a supporter from EU is charged $5.60, you get $5 in patreon and 0.60 goes to tax authorities, final money you're getting is <5$. They also handle tax collection, filling and remitting to country and provide tax reports for your records.

There are group dms (called Community tab). You can update processes and notify them directly there. It may not be as versatile as your regular communication apps like discord (eg, you can only send one image at a time to the group) but it's enough to keep some form of engagement. There is also Moderation hub to assign moderators or reported content stuff (I personally have not use this thing).

The Bad

Personally, starting patreon page was daunting to me cuz *points at FAQ and setup pages* THAT'S A LOT OF WORDS. It is not as straightforward as Ko-fi, so if you're struggling with management or suck at English like me, it can be terrifying to do the first few steps, it is a bit more advance. However, since Patreon is widely use you can ask people that has em and they'll be happy to help out, not to mention videos and tutorials out there that simplify the process. (Thank you Bressy and Shiba for helping out my initial phases)

The random ban for no reason, I've seen people who got their accounts banned when they created their patreon page, idk the full story as to why or how but, yeah it happens. Customer service varies between countries, some good some bad.

Higher charging fees, patreon takes 8% instead of 5%, if you're on premium plan then they'll take 12%. They are however, changing this and just charge 10% for ALL new blog that starts after August 4th. If you have a blog before August 4th, you'll be the 8% group still. Payment processing fees varies by region and method, typically is 2.9% + $0.40. These fees could add up quickly and offer losses over gain if you're running small tiers or have a large fan base. I also heard generated tax bookkeeping files are slightly confusing to count if you're not familiar with these business stuff.

Payout delays. Initial funs will take 5-10 days (or longer if you're unlucky) after the first pledge (like when you get a first patreon). They stay in patreon and you'll either set up automatic payout or manually withdraw them, compare to Ko-fi's instant withdrawals.

I don't know much about this but I think the Shops option differ to Ko-fi and I've heard people saying Patreon Shop setup is more finicky, so yeah that.

okay that's a lot of words so which one should I choose????

If you want simplicity, something on the side just to earn some extra income, with no thoughts about expanding it beyond a comfortable numbers of supporters (such as 10-12 members), then Ko-Fi is great. There are many memberships out there who offer benefits besides art! Such as writing, photography, editing, even algebra classes. It just really comes down to what you can offer with your skills and capabilities.

If you want to build a community, you want to continue expanding to a certain goal, you want more control over financial management, systems and tools, then Patreon is the way to go. This is especially preferred if you have content-driven mindset and if you have audiences to reach.

The reason why I am suggesting to make your patreon post now is obviously the tax increment stuff, but also if you already have that thought to have a page in the future. I understand the concern of "but i'm not ready" or "i ain't got stuff to offer", but you can always have a blank state with free memberships only. If you truly want to offer something, I believe a few passage of your current wip about your fics, or if you're an artist a simple doodle every month should probably keep your page afloat (and I mean you can ask your friends to join for free and do the engagement sillays like liking and commenting if you want extra security). Idk if patreon allows blank pages though so uhm, don't say I didn't warn you if something did happen lmao xD

I read other comments that talked abou 10% is not that high, which is fair since everyone has a different financial status and background. I'm not out here forcing anyone to start a patreon right away, I am just simply suggesting.

I wish I can make a patreon but I got nothing but my writings, which barely get any attention

I'm going to be very blunt about this and you might dislike what I am going to say, but if you have a goal you'll have to put in that effort to research, learn, experience the loss and failure, fall hard and step up again. I too, was once an account with 1 follower, and it's from Tumblr official page. My doodles were not the greatest, it's not rendered God-like, nor does it have any coherency. While I didn't think about starting memberships very early on, once I had that thought I started pushing myself to be better. Being a creative-based person online can be challenging, because if you want some financial gain from this, you'll have to put in the work to earn it. Studying what algorithm wants, what the audiences like, how other users alike are utilizing their skills to pull in the people. It's a long process that involves a lot of trial and errors, and it gets incredibly frustrating and tiring with a lot of burntout and giving up. Because you usually have to do something that you yourself may not like, but the vast majority do. You have 2 options with this kind of dilemma, stay true to yourself and do whatever you want, create and write what you want to be authentic, and find the real ones who would support you along the way, this one will be a longer road and lesser moments of "shit man, why the hell do i still write alien fucking if it throws me off." The other is okay, you figure out the people want, so time to improve and start working on that thing and slowly gain a steady amount of followers, and when you finally feel like it? start creating things you actually prefer. If they leave, they leave, if they stay, then they stay, you win some you lose some. I personally chose the second path, and yes I've lost a lot of people and support along the way, but I am happy with my progress. It took me about a year + before I launched ko-fi membership for 6 months, and then transition to Patreon now if you want a picture of my growth.

I don't think I'm there yet, even with my followings, even with patreon set up. There are many times where I still felt like what I do is inadequate and I'm ripping off their wallet with my creations and benefits. That is why I am still working my darn hardest to improve and to keep moving forward, but also to stop and reflect on my progress, to understand that these people are supporting me because they wanted to and they've been extremely kind and supportive along the way.

Well what I'm trying to say is, every foundation is hard to build, every beginning feels like torture, because it's foreign and it's tiring to even think about it, but if you want, or in other cases, need this growth and expansion, you'll have to endure it. Just like learning how to ride a bike, ya gonna fall and ya gonna bleed at times, but once you're comfortable with the handles, the rest of the ride will be easier, not smooth sailing, just easier! because there are still some bumpy road and blockage ahead, it's an ever learning curve.

Since I come from art concept, I cannot offer much advice with writings. The best way for me to improve is by looking up at what others are doing, so a good start is always connecting with others. Do you like an author's work? then read up about them like how you're putting that blorbo under a microscope and analyze the shit outta them. How do they post? What words do they use often? What prompts or premise is usually popular with their posts? What time do they post? How do they communicate with others? How do they communicate to you? How do they tag their post to reach 2k notes? How do they respond to questions about their memberships if they have one? What benefits are they offering in their pages? etc etc

idk maybe this all sounds way too much work to earn 10 pledgers in patreon, maybe all these are just way too elaborated but, at the end of the day it really depends what you want, how much are you willing to achieve the goal and how comfortable you are with these online content monthly producing responsibilities, stuff. Yeah.

Either way, I wish you all the best in your endeavors!

13 notes

·

View notes

Text

INRODUCTION

hello!!! i go by Mellon on here!!

im a beginner on posting on social media, so please be aware that i am very socially awkward and will end up causing some lag on my end

i cover lots of art for fandoms and ocs of my own, and i also prefer to post art rather than post my own thoughts. but there is the occasional post of mind

this has become a reblog account, once i have my other one set up i’ll make sure to tag it below

@rook-xb

personally, i don’t care what pronouns are used. i’d rather go by he/him or she/her, but majority of the time neos and no pronouns also work perfectly fine as well

rot/rots/rotself is the way to use the pronoun btw

the tag i will hopefully try to use:

- #voicification time for any posts that isn’t art related

i’m also apart of another account!! @in-gst

the banners belong to user Sweetmelodygraphics

and most often i have my notifications off

have fun exploring the blog!!

14 notes

·

View notes

Video

youtube

How to File ITR-1 Online for FY 2024–25 | Senior Citizen | Old vs New Ta...

How to File ITR-1 Online for FY 2024–25 | Senior Citizen | Old vs New Tax Regime|ITR-1 FY24-25LIVE! #itr1 #incometax #cadeveshthakur @cadeveshthakur 📢 Complete Guide to Filing ITR-1 Online for Senior Citizens (FY 2024–25 | AY 2025–26) If you're a senior citizen (aged 60+) or filing ITR for your parents or elders, this video is your one-stop solution to file Income Tax Return using ITR-1 Sahaj form for Assessment Year 2025–26 (Financial Year 2024–25). We also help you choose between the Old Tax Regime and New Tax Regime with a clear, step-by-step comparison of tax liability! ✅ 👇 Follow Playlist for Income Tax Return (ITR) Filing FY 2024-25 | Complete Guide https://www.youtube.com/playlist?list=PL1o9nc8dxF1R4FZlmK-5tIighYB0vxu3L 🎯 What this video covers: 🔹 Who can file ITR-1 Sahaj (eligibility criteria) 🔹 Income details required for senior citizens 🔹 Important documents checklist 🔹 Step-by-step filing on the Income Tax Portal 🔹 Comparison of Tax Liability – Old vs New Regime 🔹 Tax slabs and deductions explained (80C, 80D, 80TTB etc.) 🔹 Common mistakes to avoid 🔹 Which regime is better for senior citizens? 🔹 How to file ITR-1 online correctly with zero errors! Index 00:00 to 00:48 Introduction 00:49 to 03:48 Computation as per New Tax Regime 03:49 to 06:27 Computation as per Old Tax Regime 06:28 to 21:05 How to file ITR1 online for FY 2024-25 🧓 Specially curated for: ✔️ Senior Citizens (60 years and above) ✔️ Super Senior Citizens (80 years and above) ✔️ Children filing ITR on behalf of their parents ✔️ Taxpayers confused between Old & New Regime 📌 Must Watch Before You File ITR This Year! 👉 Don’t forget to LIKE, SHARE & SUBSCRIBE for more tax-saving content! 🔖 Tags / Hashtags for SEO #ITR1Filing2025 #SeniorCitizenTax #IncomeTaxIndia #TaxRegimeComparison #ITRforParents #IncomeTaxReturn #OldVsNewTaxRegime #ITR1FilingStepByStep #IncomeTax2025 #SahajFormITR1 #AY2025_26 #OnlineITRFiling #IndianTaxSystem #TaxTipsIndia #SeniorCitizenFinance #IncomeTaxPortal #TaxDeductionsIndia #Form16Filing #ITRHelp2025 #FileITROnline #TaxPlanningIndia #OldRegimeVsNewRegime Remember, our community is more than just a channel—it’s a family. Let’s connect, learn, and grow together! Hit that Subscribe button, tap the notification bell, and let’s spread financial wisdom one click at a time. 🚀 Remember, knowledge empowers us all! Let’s learn together and navigate the complex world of finance with curiosity and diligence. Thank you for being part of the cadeveshthakur community! 🙌 Disclaimer: The content shared on this channel is purely for educational purposes. As a Chartered Accountant, I strive to provide accurate and insightful information related to GST, income tax, accounting, and tax planning. However, please note that the content should not be considered as professional advice or a substitute for personalized consultation. If you found this video helpful, don’t forget to LIKE 👍, SHARE ↗️ it with your friends, and SUBSCRIBE 🔔 to my channel, cadeveshthakur, for regular updates on GST, accounting, finance, and the latest market insights. ✨ Press the Bell Icon 🔔 so you never miss an update and get notified the moment I upload a new video packed with valuable information just for you! Your support helps me create more content to simplify complex topics and keep you informed. Thank you! 😊

0 notes

Text

VOspaces: Your Trusted Partner for Virtual Office & Mailing Address PAN India

In today’s business landscape, flexibility, professionalism, and cost-efficiency are more important than ever. Whether you are a startup, freelancer, entrepreneur, or growing enterprise, having a credible business presence is crucial—especially when registering with government bodies or building trust with clients. That’s where VOspaces, a trusted provider of Virtual Office & Mailing Address PAN India, steps in to transform the way modern businesses operate.

As the demand for remote work and digital entrepreneurship grows, so does the need for smart, affordable, and fully compliant workspace solutions. VOspaces makes it possible for you to maintain a professional address for business registration in India without the need to invest in expensive office rentals.

Let’s explore how VOspaces empowers businesses across the country with reliable, compliant, and convenient virtual office solutions.

What Is a Virtual Office?

A virtual office is a service that enables businesses to use a real, physical business address for official correspondence, registration, and mail handling—without occupying the space physically. It’s the perfect solution for companies looking to build credibility, register with tax authorities, or maintain a local presence in a specific city, without bearing the cost of leasing and maintaining a traditional office.

With VOspaces, businesses get access to Virtual Office & Mailing Address PAN India, including services like:

Business address for GST and company registration

Mail receiving and forwarding

Dedicated customer support

Necessary documentation like NOC, utility bill, and rent agreement

Why a Professional Business Address Matters

In India, most government departments, banks, and regulatory bodies like the Ministry of Corporate Affairs (MCA) or GST department require businesses to provide a verifiable commercial address for registration. Using a home address often leads to disqualification or legal challenges.

A professional address for business registration in India not only helps you stay compliant but also builds trust among clients, vendors, and investors. With VOspaces, you can get a ready-to-use virtual address in prime locations—whether you’re looking for a virtual office in Kanpur or any other Indian city.

VOspaces Services at a Glance

VOspaces offers more than just an address. Here’s what sets it apart from typical virtual office providers:

PAN India Virtual Office Network

From metros to Tier-2 and Tier-3 cities, VOspaces offers Virtual Office & Mailing Address PAN India. You can choose locations based on your market focus, GST requirements, or business expansion plans.

Documentation for Compliance

Each virtual office package includes all necessary documents for seamless registration:

NOC (No Objection Certificate)

Rent Agreement

Utility Bill

These documents are accepted by GST departments, ROC (Registrar of Companies), and banks for opening business accounts.

Mail Handling & Forwarding

Never miss a business communication. VOspaces receives your mail and forwards it to your preferred location. Mail scanning and email notifications are also available.

Affordable & Flexible Plans

Designed with startups and small businesses in mind, VOspaces provides flexible pricing that allows you to establish a presence without heavy overhead costs.

Why Businesses Choose VOspaces

Nationwide Coverage

VOspaces operates across India, so whether you need a virtual office in Kanpur, Mumbai, Delhi, Bengaluru, or Ahmedabad, you're covered. You can expand into new markets and register in multiple states without opening physical offices.

Ideal for Business Registration

If you're registering a private limited company, LLP, or applying for GST, VOspaces gives you the professional address for business registration in India that meets all compliance standards.

GST-Ready Virtual Office

Need a GST registration in another state? VOspaces provides GST-compliant documentation that simplifies inter-state registration and enables seamless invoicing and taxation.

Easy Setup & Expert Support

Our onboarding team walks you through the entire process—from selecting the right address to providing necessary legal documentation and assistance for GST or ROC applications.

Use Case: Virtual Office in Kanpur

Let’s say you're an e-commerce seller based in Pune, but you're expanding operations to Uttar Pradesh. Rather than setting up a new branch office in Kanpur, VOspaces allows you to get a virtual office in Kanpur—complete with a local business address and mail handling. You can now register for GST in UP, issue local invoices, and build brand trust in that region—without ever renting physical space.

This is especially useful for:

Amazon/Flipkart sellers

Consultants serving clients in specific regions

Startups testing new markets

Service providers needing multi-state GST presence

Who Can Benefit from VOspaces?

VOspaces is ideal for:

Startups needing compliance-ready office addresses

Freelancers & solopreneurs building credibility

SMEs expanding into new markets without high overheads

E-commerce sellers needing state-wise GST registrations

Consulting firms wanting a presence in multiple locations

The VOspaces Advantage

Feature VOspaces Benefit PAN India Access Operate anywhere in India Government Compliant GST, ROC, MSME ready Affordable Starting at low monthly rates Quick Setup Get your documents within days Trustworthy Locations Prestigious business districts

Future-Ready, Compliant, and Trusted

In a business world that’s going digital and decentralized, VOspaces gives you the structure you need to operate legally, look professional, and grow efficiently.

A virtual office is no longer just a luxury—it’s a necessity for modern businesses that want to be lean, credible, and agile. Whether you're a solo entrepreneur or managing a growing team, VOspaces provides the tools to register, manage, and scale your business from anywhere.

Get Started with VOspaces Today

Ready to boost your business credibility and register with confidence? Explore VOspaces’ Virtual Office & Mailing Address PAN India plans today. Whether you need a virtual office in Kanpur, Mumbai, Chennai, or beyond—VOspaces delivers compliant, cost-effective, and seamless solutions.

Visit VOspaces.com to choose your city, plan your growth, and get a professional address that takes your business further.

0 notes

Text

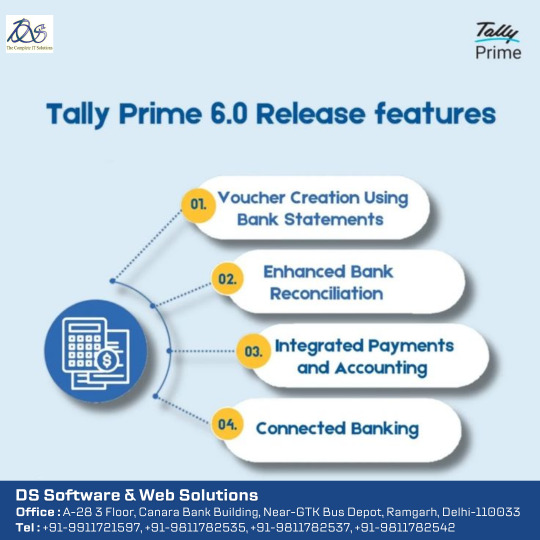

TALLY PRIME 6.0 RELEASE FEATURES

Here’s a comprehensive overview of the new capabilities in TallyPrime 6.0, officially released on 9 April 2025

1. Connected Banking & Automation:-

Real‑time bank integration: Connect securely to your bank using Tally.NET credentials to view live balances and statements inside Tally.

Auto‑voucher creation: Import bank statements to automatically generate payment/receipt vouchers with full details (narration, instrument no/date), in bulk or merged.

Smart reconciliation & e‑payments: One-click matching with rule-based and bulk options; create and track NEFT/IMPS payment files via e-Payment module supporting 18+ Indian banks.

2. Enhanced Banking Reports & Dashboards:-

New Banking Activities dashboard tile: shows pending reconciliations, balances, e‑payment statuses with drill-down reports.

Improved reporting in vouchers/day‑books, capturing bank account, instrument and reconciliation status; detailed Edit Log now tracks changes to UPI, bank date/instrument.

3. Streamlined Data Split & Verification:-

Simplified Data Split: new interface with enhanced options—single or dual company splits, progress bar, and robust pre‑split verification.

Resolves memory glitches and errors during large data operations .

4. Profile Management & Notifications:-

In‑app Profile section: modify contact info tied to serial number directly in Tally.

Semi‑annual reminders ensure your contact details stay current.

5. GST, TDS, VAT & Tax Enhancements:-

GSTR‑1 improvements: smarter filing with Excel Utility v5.4 for GSTR‑3B and breakup of B2B/B2C HSN summaries (Phase III from 1 April 2025).

Enhanced TDS/VAT reporting: precise calculations and correct state-wise reporting.

GCC compliance: bilingual (English/Arabic) invoicing, Arabic numerals, VAT formats for Kuwait/Qatar.

6. Income‑Tax & Regulatory Updates:-

Updated support for Income-Tax slabs under the 2025–26 Finance Bill, including rebate (87A), marginal relief, revised Form 16/24Q annexures.

7. Developer (TDL) Enhancements:-

New attributes & functionality: Skip-Forward, Disable Period on Tile, Multi‑Objects, IsPatternMatch, and Recon Status collection filter.

Internal optimization: Opening BRS details moved out of bank master to improve performance.

#tallyprime#tally on cloud#accountingsoftware#tallysoftware#cloud accounting software#cloudcomputing

0 notes

Text

What Does a GST Consultant Do & Why Your Business Needs One

In the ever-evolving landscape of taxation in India, the Goods and Services Tax (GST) stands out as a landmark reform that has redefined how businesses handle tax compliance. While GST has brought about simplicity by subsuming multiple indirect taxes, it has also introduced complex rules, strict timelines, and frequent updates that many businesses struggle to keep up with. That’s where a GST consultant becomes invaluable.

Whether you're a startup or an established business, a professional GST consultant can help you navigate GST regulations efficiently and stay compliant with ease. But what exactly does a GST consultant do, and why should your business consider hiring one? Let’s find out.

Who is a GST Consultant?

A GST consultant is a tax professional who specializes in the provisions, processes, and filings related to GST. These experts stay up to date with the latest GST rules and help businesses comply with the law while maximizing benefits like input tax credits and avoiding penalties.

They may work independently or as part of a tax advisory firm, and many are qualified Chartered Accountants (CAs), Cost Accountants, or legal professionals with experience in taxation.

Key Roles and Responsibilities of a GST Consultant

Here’s a breakdown of the core responsibilities of a professional GST consultant:

1. GST Registration and Compliance

One of the primary responsibilities of a GST consultant is to assist businesses in GST registration. They help determine whether a business is liable to register and handle the paperwork and submissions required by the GST portal. Once registered, the consultant ensures ongoing compliance, including timely filing of GSTR-1, GSTR-3B, and annual returns.

2. Input Tax Credit (ITC) Management

Maximizing input tax credit is crucial for cost efficiency. A GST consultant helps businesses correctly claim ITC by maintaining accurate records, reconciling purchase invoices, and ensuring compliance with the matching principle under GST law.

3. Filing of Returns

Timely filing of returns is essential to avoid penalties. A professional GST consultant prepares and files various GST returns on your behalf and ensures accuracy in data reporting, which reduces the risk of audit flags.

4. GST Audit and Assessment

In case of a GST audit, having a knowledgeable consultant by your side can make a significant difference. They assist in preparing the necessary documents, replying to notices, and representing the business before tax authorities.

5. Advisory Services

A GST consultant also provides ongoing advisory on changes in GST rules, pricing strategies involving GST implications, tax planning, and impact analysis of new GST notifications or circulars that may affect your business operations.

Why Your Business Needs a GST Consultant

1. Ensures Full Compliance

GST regulations are updated frequently. A professional GST consultant keeps track of all changes and ensures that your business remains fully compliant. This minimizes your risk of legal notices, penalties, or interest.

2. Saves Time and Resources

Handling GST compliance internally can be time-consuming and error-prone, especially for small and medium-sized enterprises. By outsourcing to a GST consultant, your internal team can focus on core business functions instead.

3. Avoids Penalties

Incorrect filings, delays in return submissions, or failure to reconcile ITC can lead to penalties. A GST consultant helps you avoid these pitfalls by managing your tax obligations professionally and timely.

4. Helps with GST Planning

Every business wants to reduce tax liability within legal limits. A GST consultant offers strategic advice to structure transactions in a tax-efficient manner while remaining within the framework of the law.

5. Expertise in Handling Complex Situations

Whether it's a GST refund, a demand notice, or export-related compliance, a professional GST consultant has the experience to guide you through complex scenarios without risking non-compliance.

Conclusion

Hiring a GST consultant is no longer a luxury but a necessity for businesses operating in today’s dynamic regulatory environment. From simplifying compliance and saving time to avoiding penalties and optimizing tax benefits, a professional GST consultant adds immense value to your business.

If you want to stay ahead in tax compliance and focus on your business growth, consider partnering with a trusted GST expert today. Your business deserves the peace of mind that comes from professional support.

0 notes

Text

Still Following Up with Vendors on WhatsApp? Streamline Everything with VMS

Managing vendors through WhatsApp messages, endless calls, and scattered spreadsheets might seem quick at first—but over time, it leads to delays, miscommunication, and missed opportunities. If your procurement or supply chain team is constantly chasing vendors for quotes, order status, and payment clarifications, it’s time to upgrade to a Vendor Management System (VMS).

In this blog, we’ll explore the common vendor-related challenges businesses face and how a modern VMS like BETs can streamline, centralize, and automate your vendor operations—from onboarding to invoice settlement.

The Problem with Managing Vendors Over WhatsApp & Excel

Relying on WhatsApp or manual tools for vendor coordination often leads to:

Untraceable Conversations Crucial details like quoted rates, delivery schedules, or order confirmations get lost in chat history.

Manual Errors Mistakes in rate entries, PO mismatches, or unrecorded agreements become common.

No Performance Tracking There’s no real way to evaluate vendor performance over time.

Delayed Approvals & Follow-Ups Cross-department coordination slows down because there’s no structured workflow.

Compliance Issues KYC documents, contracts, or certification renewals are often outdated or missing.

How Vendor Management Software (VMS) Solves These Issues

A modern VMS brings all vendor-related activities under one integrated platform. Here’s what BETs VMS offers:

1. Centralized Vendor Onboarding & KYC

No more sending KYC forms over email or storing documents in scattered folders. Vendors can:

Upload company documents via their login

Submit GST, PAN, bank details, certifications

Receive onboarding status updates

And you stay compliant with a complete digital trail.

2. Catalog & Rate Management

Vendors can manage their product/service catalog, update prices, and share special rate contracts—all in one place. You can:

Compare quotes across vendors with RFQ analysis

Set valid-from/to pricing

Avoid price mismatch issues at PO generation

3. Smart RFQ & PO Tracking

Raise RFQs with ease and track responses in real-time. Once approved, the VMS:

Converts RFQ to Purchase Order automatically

Sends PO notifications to vendors

Allows vendors to accept/reject or comment on POs

No more WhatsApp messages asking “Have you received the PO?”

4. Real-Time Order & Delivery Tracking

Vendors can update dispatch details, vehicle info, and expected delivery time from their panel. You can:

Monitor delivery timelines

Manage vehicle entry at the security gate

Integrate with QC module for incoming inspection

5. Vendor Performance Matrix

Track performance across metrics such as:

On-time delivery %

Quality rejections

Price competitiveness

Response time on RFQs

Use the insights to negotiate better, optimize supplier base, or even reward your top vendors.

6. Payments, Invoice Booking & Settlement

Vendors can upload invoices directly against delivered POs. The system lets you:

Validate invoices with GRN (Goods Receipt Note)

Track payment status (Pending, Processed, Paid)

Avoid disputes and endless follow-ups

7. Document Management & Compliance Alerts

Get auto-reminders for:

Contract renewals

Expiring certifications

Compliance document re-submissions

All stored securely and accessed instantly.

Seamless Integration with ERP & Other Systems

BETs VMS integrates seamlessly with your existing ERP or procurement modules, ensuring that:

Purchase, finance, QC, and stores departments stay aligned

No duplicate data entry

Reporting is real-time and accurate

If you’re still following up with vendors on WhatsApp, you're not just wasting time—you’re also risking data errors, compliance failures, and missed cost-saving opportunities.

BETs Vendor Management Software empowers businesses with a structured, automated, and intelligent platform to manage the complete vendor lifecycle. From onboarding to evaluation, it’s all streamlined—so your team can focus on strategic procurement, not repetitive coordination.

Ready to Upgrade?

Book a free demo to see how BETs VMS can revolutionize your vendor ecosystem. Let your WhatsApp stay personal—leave vendor management to professionals.

To know more,

Visit Us : https://www.byteelephants.com/

0 notes

Text

GST REG-07: New GST Compliance Guidelines for Metal Scrap Buyers

Table of ContentsBackground Of GST REG-07GSTN Introduces Update To Facilitate RegistrationRegistration Requirement For TaxpayersYou May Also LikeGet Free Updates[Join WhatsApp Group] Background Of GST REG-07 The government had issued Notification 25/2024-Central Tax, on October 9, 2024 to mandate compliance under section 51 of the CGST Act 2017 by the businesses dealing with Metal Scrap (Form…

0 notes

Text

Empowering Tax Professionals with Comprehensive Resources and Services

In the complex world of taxation, staying updated with the latest laws, judgements, and legal documents is crucial for professionals and businesses alike. As the tax landscape evolves, the need for reliable, accessible, and comprehensive resources becomes more apparent. This article explores how innovative platforms are transforming tax research and legal documentation.

The Significance of a Robust GST ELibrary The Goods and Services Tax (GST) has revolutionized India's taxation system, introducing intricate rules and regulations that require constant vigilance. An essential resource for tax practitioners, the GST ELibrary consolidates a vast array of legal texts, notifications, circulars, and procedural updates in a centralized digital platform. By providing easy access to authoritative content, it reduces the time spent searching through multiple sources and helps professionals interpret complex GST provisions accurately.

The GST ELibrary is designed to be user-friendly, offering features such as advanced search filters, bookmarking, and regular updates. This ensures that users stay ahead of the curve, equipped with the latest legal developments and clarifications. Whether it's understanding input tax credits, reverse charge mechanisms, or compliance requirements, a comprehensive GST ELibrary serves as an indispensable tool for legal firms, corporate tax departments, and consultancy agencies.

Elevating Legal and Tax Practice with Tax Library Services Beyond statutory texts, the practical application of tax laws often involves detailed documentation and procedural guidance. This is where specialized Tax Library Services come into play. These services encompass a wide range of offerings, including access to legal templates, case law databases, commentary, and expert analysis. By leveraging such services, tax professionals can streamline their workflows, ensure accuracy, and maintain compliance with current regulations.

Tax Library Services often include subscription-based platforms that provide continuous updates, expert insights, and easy integration with existing workflows. They serve as a vital backbone for legal research, drafting legal notices, or preparing compliance reports. Moreover, these services facilitate better decision-making by offering contextual understanding of tax laws, judgements, and procedural nuances.

Simplifying Legal Documentation with Pre Drafted Deed & Standard Services India Legal documentation can be time-consuming and complex, especially when dealing with numerous transactions and contractual obligations. To address this challenge, Pre drafted deed & standard services India" offer ready-to-use legal documents that are tailored to common business needs. These templates are drafted by legal experts, ensuring they adhere to current laws and best practices.

Using pre drafted deeds and standardized services allows businesses and legal practitioners to save valuable time and reduce errors. These documents cover a broad spectrum of agreements like lease deeds, partnership agreements, sale deeds, and power of attorney. They also ensure consistency across documents and facilitate quick approvals, which is crucial in fast-paced business environments.

The availability of such standardized legal templates is particularly beneficial for small and medium enterprises that may not have the resources for custom drafting. It promotes legal compliance, reduces legal costs, and accelerates transaction processes.

Accessing Justice and Legal Insights with the GST Judgements Book One of the most critical aspects of legal research is understanding how courts have interpreted and applied laws in real cases. The GST Judgements book compiles key judicial rulings related to GST, offering invaluable insights into legal reasoning and precedents. This resource helps practitioners anticipate judicial trends, craft stronger legal arguments, and advise clients more effectively.

A well-curated judgements book is an essential reference for lawyers, tax consultants, and corporate legal teams. It covers significant cases, detailed judgments, and interpretations that influence ongoing and future litigation. Staying updated with such judgements ensures that professionals are well-informed about the evolving judicial landscape and can adapt their strategies accordingly.

Furthermore, accessing a comprehensive GST judgements book enhances legal research efficiency. Instead of sifting through numerous case reports, practitioners can quickly locate relevant rulings, understand the rationale behind judgments, and apply these insights in their practice.

0 notes

Text

What are the best GST compliance audit tips for Virtual Office users?

GST compliance is of vital importance to all businesses, including startups, freelancers, agencies, and more that function through virtual office buildings. The virtual office space registration address applies fully to corporate GST registrations, provided the support documentation is compliant. With the right business address, virtual office users can run operations from anywhere, simultaneously meeting tax and official obligations. However, compliant stays exceed fair registration.

This includes accurate feedback, proper documentation and clear communication with GST authorities. In this blog, we look into key compliance audit tips for virtual office users. We will explain practical examples, frequent mistakes and best practices to help freelancers and businesses maintain clean GST recordings and avoid penalties.

Understand the meaning of virtual offices and GST

Virtual offices do business addresses without requiring physical occupation of office space. This model is especially useful for freelancers, startups and remote teams looking for virtual offices to address communication and meet legal procedures. Such addresses are accepted for business GST registrations if they are equipped with valid documents such as rental agreements, pension calculations, NOCs and more. After registration, virtual office users must follow the same GST rules as physical companies. This includes sending a return, appropriate ITC, and reply messages.

The GST department does not distinguish between an under-test virtual setup and a traditional setup. Therefore, users should ensure that the virtual office fully meets the GST standard to avoid legal or financial issues.

Key GST Compliance Challenges for Virtual Office Users

Virtual offices are efficient and cost-saving, but are equipped with specific challenges to GST conformance that users must deal with with caution.

1. Incomplete documentation:- Many users skip collecting all the documents they need, including rental agreements, electricity bills, NOCs and more. This often leads to rejection or delays in reviews during GST registration.

2. Incorrect communication with a service provider:- Your virtual office provider may not provide GST-compliant documentation. This can lead to adjustments to document shortages during audits and pose a compliance risk.

3. false gstin link:- Users often forget to update their GST profile when their virtual office address is deferred. This can lead to the fact that it deals with legal complications that are considered mischief.

4. I missed the deadline for submission:- Without physical memory, users can overlook the GSTR-1 or GSTR 3B registration date. These lack of deadlines attract late fees, penalties and GST messages.

5. ITC error (input tax credit):- Inappropriate persecution of ITC claims leads to false calculations. Companies can blame ITCs and cause audits or ITC rejections.

To address these challenges, choose a trusted provider for your virtual office, take a timely registration plan, and consult an expert about the accuracy of your ITC and GST registration.

GST Compliance Audit Tips for Virtual Office Users

The rest of the GST audit response is very important for virtual office users. Below are some proven tips for enhancing compliance:

1. own GST compliant documentation:- Always collect rental contracts, supply calculations and NOCs from your provider. Organize your software and hard copies as the examiner may request you at any time.

2. Files will be returned on time:- lines will be returned on time Late GST Return Registration can increase the red flag of the test and beget discipline. Set up calendar notifications or use our specialists to ensure timely GSTR-1, GSTR-3B, and annual return recipients.

3. Reconcile Input and Output Tax:- Please vote regularly for GSD-2B input data using actual purchase calculations. Also, to avoid incorrect adjustments, we will start a starting tax record with the GSTR-3B.

4. Use professional accounting tools:- Software such as Zoho, QuickBooks, and Tally automated tax calculations and applications. It also helps you pursue invoices and reduce the risk of manual GST errors.

5. Check the GSTIN details regularly:- Check the GSTIN details regularly Update the GST gate if the office address is changed or if the service provider is replaced. Incorrect details can lead to an exam and cancel your registration.

The right documentation, technical tools, and timely updates make a big difference.

Virtual office users need to manage GST compliance as thoroughly as physical office owners to maintain test tightness.

Practical Example: GST Compliance for a Virtual Office User

Scenario:

Ravi is a freelance digital marketer operating from Mumbai using a virtual office in Bangalore. He registered for GST using the virtual office address provided by a co-working space.

Steps Ravi Took to Stay Compliant:

1. Verified Documentation:- He ensured the co-working space gave him a rent agreement, electricity bill, and a valid NOC—all in his business name.

2. Accurate GST Filing:- Ravi filed GSTR-1 and GSTR-3B every month using accounting software, ensuring timely and error-free submissions.

3. Proper ITC Reconciliation:- He matched all purchase invoices with GSTR-2B before claiming input tax credit, avoiding mismatches.

4. Professional Help:- He consulted a GST expert quarterly for audit prep and updated advice.

5. Maintained Records:- Ravi stored all invoices, returns, and GST-related communication digitally and in hard copy.

Ravi passed a random GST audit without issues. His virtual setup didn’t affect compliance, thanks to timely filings and accurate documentation.

Common Mistakes Virtual Office Users Should Avoid

Operations through a virtual office are efficient, but certain frequent errors can lead to serious issues with GST compliance.

To continue to fit, users must avoid these errors and follow the correct steps diligently.

1. Use incomplete documentation:- Submitting GST registration to missing documents such as NO Input Certificate Certificate (NOC), rental agreements, or pension calculations can lead to applications for applications. Even if it is approved, you may get a red flag due to lack of appropriate documentation during the GST audit or review.

2. Do not update GST portal address:- If you have changed your virtual office provider but forget to update your address in the GST portal, this will cause disagreement. This non-meeting may lead to cancellation of GST messages and GSTINs if not improved within the time limit.

3. Overlooked by GSTR:- Freelancers or small teams often miss monthly or quarterly GST submissions such as GSTR-1 and GSD-3B. Lack of single returns can lead to interest, punishment and suspension of GST input-lone claims.

4. Bad invoice management:- There are no invoices, false tax rates, or inappropriate explanations are normal errors. Such invoices are often marked during audits, leading to input -deed (ITC) rejection.

5. Relying on Unverified Providers:- Choosing a cheap and impossible virtual office provider can be dangerous. If you do not provide GST-compliant documents, registration and compatibility will be reduced.

Keep GST compliant by checking providers, double checks of documents and accurate persecution of all submissions.

Proper Reconciliation of Input Tax Credit (ITC) (

For businesses using virtual offices, adjustment to ISTIP Tax Credit (ITC) is one of the most important GST compliance functions. With proper adjustments, we will ensure that your claims are valid and you are ready for review.

1. Complete purchase calculation using GSTR-2B:- Compare your supplier invoices with GST data automatically generated by the GST portal each month. Any inseparable from what the supplier reports and what it claims could lead to ITC is rejected.

2. Check seller compatibility:- Even if you purchase it, ITC will not be reflected unless the supplier files GSD-1. Follow your provider regularly to make sure you lose or risk your input credits.

3. Use the ITC Matching Tool:- Accounting software such as Tally, Quickbooks, and Zoho books can simplify your contract with GSTR-2B. These tools help reduce manual work, quickly identify incorrect adjustments, save time and reduce errors.

4. Assert only justified ITC:- Not all purchases can be excluded for personal expenses, fuel, or entertainment calculations. Understand the admission criteria before claiming ITC to avoid illegal claims.

5. Holds digital accounting protocols:- Save scanned copies or PDFs of all invoices with GST details securely, in a well-organized, digital format.

This ensures quick access and prompt proof of audits or department enquiries.

Adequate ITC voting will minimize audit risks, ensure smooth refund processing, and strengthen your GST compliance attitude.

FAQs

1. Can I register with GST using a virtual office address?

Yes, if you submit valid documents such as rental agreements, NOCs, and supply invoices, you can register with GST based on your virtual office space address.

2. Is the GST Audit Virtual Office accepted?

Yes, as long as your documents are GST compliant, your virtual office will be treated as well as a physical office during an audit.

3. Can Freelancers deal with the virtual official tax of Input-Deed (ITC)?

Yes, when Freelancers issue a GST invoice, they can invoice ITC and can be considered output according to the GST rules.

4. What happens if I change my virtual office address?

We will update the new address in the GST portal immediately to avoid disapproval and legal issues.

Conclusion

Virtual offices provide a smart, cost -effective way to run modern businesses without the burden of physical infrastructure. A virtual office space address can be legally used for commercial GST registration when supported by correct documentation.

However, GST compliance requires careful attention - accurate filing, eligible ITC claims, and timely updates are required. Businesses should select reliable providers, maintain appropriate records, and be cautious to change tax rules. By following the best practices, virtual office users can avoid audit, punishment and disruption.

With discipline and smart planning, a virtual office can help businesses be flexible and fully comply in today's competitive digital economy.

0 notes

Text

Master Advanced Digital Marketing with SoftCrayons Tech Solutions

Advance digital marketing training | Digital marketing course | Advance digital marketing course in Ghaziabad

As technological developments shift at a speeding momentum, skilled digital marketing skills have become critical for professionals, entrepreneurs, and students alike. SoftCrayons Tech Solutions, a leading IT training institute in Delhi NCR (Noida, Ghaziabad, and Delhi), provides a high-impact Advanced digital marketing training that fosters strategic thinking, technical expertise, and practical application.

Why Attach to the Fundamentals?

Many marketing courses focus solely on fundamentals—but Advanced digital marketing training demand much more

In-depth analytics, A/B testing, and multi-touch attribution techniques

Integration of AI tools like chatbots, automation workflows, and predictive targeting

Cross-channel synergy that blends SEO, PPC, social advertising, influencer, email, mobile, and affiliate marketing into a cohesive strategy

What You’ll Learn

1. SEO & Search Intelligence Comprehensive keyword research, on-page and off-page optimization, mobile and voice search focus, and staying ahead of algorithm updates .

2. SEM & PPC Campaigns Design and manage targeted Google Ads and social ad campaigns, optimize bids smartly, and implement retargeting for higher ROI.

3. Social & Influencer Marketing Launch paid campaigns on platforms like Facebook, Instagram, LinkedIn, and TikTok; collaborate with influencers to expand brand visibility and engagement.

4. Content & Email Automation Create compelling, SEO-optimized content and build automated email drip campaigns to nurture leads into customers.

5. Analytics & Optimization Master Google Analytics, build robust multi-channel dashboards, run A/B tests, and apply conversion attribution models for deeper insight.

6. Mobile Marketing & Chatbots Deploy mobile-specific strategies—push notifications, chatbot workflows, and app-based campaigns—to reach mobile-first audiences.

7. Affiliate & Performance Marketing Set up affiliate programs and manage performance-based marketing channels effectively to drive measurable growth.

Real-World Learning Experience

Live Projects: Gain practical experience with actual brands and performance budgets, creating a portfolio that really speaks .

Seasoned Trainers: Learn from industry professionals with over 15 years of hands-on expertise.

Flexible Formats: Attend in-person sessions in Noida or Ghaziabad—or choose live online options to suit your schedule.

Career Assistance: Receive comprehensive support through resume building, mock interviews, and connections with top recruiters .

Who Should Enroll?

This program is perfect for:

Career changers looking to enter digital marketing

Professionals aiming to advance beyond basic knowledge

Entrepreneurs seeking to grow their online presence

Students aspiring for in-demand roles in digital marketing across India

Career Paths & Salary Potential

Graduates of this comprehensive program are well-prepared for roles such as:

Digital Marketing Executive or Specialist

SEO/SEM Analyst

Social Media & Content Strategist

Digital Marketing Manager

Local data indicates entry-level professionals can expect salaries of around ₹2.5 to ₹5 LPA, thanks to the deep practical training and placement support offered

What Makes SoftCrayons Tech Solutions Stand Out

Founded in 2010, serving Delhi NCR, Noida, and Ghaziabad regions .

Offers small-batch training for personalized attention from experienced mentors .

High success rate—graduates land roles with top Indian organizations and agencies .

Affordable pricing: six-month advanced digital marketing courses at approximately ₹38,000 + GST

FAQs Snapshot

Do I need prior marketing experience? No—course materials support all learners, from beginners to experienced marketers.

How long is the course? The program runs for six months with live and interactive sessions.

Is placement support included? Absolutely���students receive help with resumes, interview preparation, and access to hiring networks.

Where are classes held? Locations include Noida and Ghaziabad, with a live online option for distance learners.

Ready to Elevate Your Skills?

To take the next step:

Request a free demo class to explore the curriculum firsthand.

Choose your batch and preferred learning format.

Begin your advanced digital marketing journey with expert-led modules.

Leverage strong placement support to secure a high-growth role.

Final Thoughts

SoftCrayons Tech Solutions' Advanced digital marketing training is more than simply an education; they are a career booster. With hands-on projects, experienced guidance, various delivery methods, and strong placement assistance, you'll develop the strategic, analytical, and technical abilities required for success in today's digital environment. Contact us

1 note

·

View note

Text

As the deadline for filing amnesty applications under Section 128A of the CGST Act draws near, taxpayers are urged to ensure timely submission. Despite a substantial number of filings—over 3.02 lakh applications as of June 8, 2025—several users have encountered technical issues preventing them from completing the process on the GST portal. To assist in overcoming these challenges, the GST Network (GSTN) has released an advisory outlining alternative steps. With over 3 lakh waiver applications already submitted under Section 128A of the CGST Act, many taxpayers are reportedly facing issues on the GST portal. The government has issued an advisory and provided alternate steps for smooth filing before the deadline. Current Filing Status Total Applications Filed as of June 8, 2025: 3,02,658 Application Forms Used: SPL-01 and SPL-02 Issue Noted: Some taxpayers face portal-related technical difficulties in submitting their waiver applications. Alternative Filing Solution Provided Taxpayers unable to file their waiver applications due to technical glitches are advised to follow an alternative method published by GSTN. The step-by-step guidance can be accessed via the following link: 👉 https://tutorial.gst.gov.in/downloads/news/link_data.pdf This guide is expected to help affected users submit their applications effectively before the window closes. Reporting Further Issues In case the alternate steps do not resolve the issue: Taxpayers should immediately raise a complaint on the GST Self-Service Portal. Official support can be accessed here: 👉 https://selfservice.gstsystem.in This ensures the issue is formally recorded and addressed in time. Advisory on filing of Amnesty applications under Section 128A of the CGST Act The taxpayers facing technical issues which is restricting them to file amnesty applications are advised to adopt the alternative route of manual entry of order details on the portal by following the steps outlined below: a. While initiating the filing of application, taxpayers are advised to enter ‘No’ against ‘Whether the demand order is issued through the GST Portal’. b. In the field “Details of demand order”, taxpayers shall enter the order number with the prefix of “ONL”. Example: If the online order number is ABCDE12345X1Z2, the taxpayer has to enter the order number as ONLABCDE12345X1Z2. Note: If the exact order number (as already recorded in the system under online mode) is entered without any modification, the system will restrict filing under manual mode, as the order was originally issued online. c. The editable details in the Basic Details table shall be entered manually d. Once this step is completed, the Order details, Payment details, and Demand related information can be entered manually by the taxpayer. e. In cases where the taxpayer has made the duty payment through DRC-03, the relevant details may be furnished in Table 4. However, if the payment has been made using the 'Payment towards demand' option, such details cannot be entered in this table. Taxpayers are accordingly advised to upload the payment details separately in such cases. Full Notification Subject : Advisory on filing of Amnesty applications under Section 128A of the CGST Act Jun 11th, 2025 1. As on 08.06.2025, a total of 3,02,658 waiver applications have been filed through SPL-01/02. However, it has come to notice that certain taxpayers are facing difficulties in filing amnesty applications under Section 128A on the GST portal. In view of the approaching last date for submission, various trade bodies have submitted representations requesting an alternate mechanism to facilitate filing. 2. In view of the above, taxpayers who are facing technical issue which is restricting them to file waiver application are advised to adopt the steps outlined in the below link:https://tutorial.gst.gov.in/downloads/news/link_data.pdf 3. Difficult if any, faced by the

taxpayers in filing applications through this route may immediately be brought into the notice of GSTN by raising a complaint on GST Self-service portal : (https://selfservice.gstsystem.in) Thanks, Team GSTN Conclusion The government aims to support all taxpayers seeking relief under the amnesty scheme by ensuring that no eligible applicant is left out due to technical barriers. All those facing portal issues should promptly follow the alternative filing method and report any persisting problems through the self-service portal. Timely action is essential as the deadline approaches rapidly.

1 note

·

View note

Text

How a Virtual Office in Bangalore Reduces Business Operational Costs

In a city like Bangalore—India’s tech powerhouse—startups, freelancers, and even established businesses are constantly seeking smarter ways to manage costs without compromising professionalism. One powerful solution that has emerged over the last few years is the virtual office model. Designed for the digital age, a Virtual Office in Bangalore enables companies to maintain a professional presence without the overheads of a traditional lease.

But what exactly does a virtual office offer? How does it contribute to lean operations? And more importantly, can it truly help reduce your business's monthly expenses?

Let’s unpack how switching to a virtual office can significantly cut operational costs while still providing the infrastructure and credibility businesses need to grow in a competitive market.

What Is a Virtual Office, Really?

A virtual office provides a professional business address and access to essential services like mail handling, call forwarding, GST registration support, and meeting rooms—all without the need for renting a physical office.

You operate your business remotely (from home or anywhere), but to the outside world—clients, vendors, and authorities—it appears you have a prime business location in Bangalore. This blend of flexibility and professionalism makes virtual offices a cost-effective alternative for modern businesses.

Top Ways a Virtual Office in Bangalore Reduces Costs

Let’s take a detailed look at the core operational expenses you can slash by going virtual:

1. Say Goodbye to Rent and Utilities

Traditional office space in Bangalore, especially in prime areas like Koramangala, MG Road, Indiranagar, or Whitefield, comes with hefty monthly rents—ranging anywhere from ₹25,000 to ₹1,00,000+ per month for even modest setups. Add electricity, water, internet, and maintenance, and your monthly expenses skyrocket.

A virtual office eliminates these costs entirely. You pay a nominal monthly fee (typically between ₹800 to ₹2,000) for a business address, and only pay extra when you use additional facilities like meeting rooms.

Cost Savings: Up to 90% savings on rent and utilities.

2. No Need for Full-Time Reception or Admin Staff

A physical office often requires you to hire staff for reception, mail handling, and admin duties, even if your daily visitor count is low.

Virtual offices include automated services like:

Professional mail handling

Call forwarding

Receptionist services (in some plans)

Courier notifications

This means you can appear organized and professional without spending on salaries.

Cost Savings: ₹15,000–₹30,000/month in staffing costs.

3. Avoid CapEx on Furniture, Equipment & Setup

Setting up a new office means you’ll need:

Desks, chairs, storage units

Networking equipment

Office branding and signage

Printers, routers, and other tech tools

Even a small office can easily demand an initial setup cost of ₹1–₹5 lakhs. With a virtual office, you skip all that.

Meeting rooms and workstations are available on-demand, so you only pay when you need them.

Cost Savings: Upfront ₹1–₹5 lakh in setup, plus maintenance.

4. GST Registration Without Renting an Office

To register for GST in Bangalore, you need a local address. Many startups or out-of-state companies end up renting an office just for this purpose.

Most virtual office providers offer GST-compliant address documentation, including:

NOC

Rent agreement

Utility bills

This allows you to get a valid GST number without leasing property, especially useful for:

Ecommerce sellers

Service providers

Consultants expanding into Bangalore

Cost Savings: Avoid unnecessary leases just for registration.

5. Reduced Commuting and Transport Costs

With your team operating remotely, commute costs go down drastically. No cab reimbursements, no fuel allowances, and no parking expenses.

For businesses with small teams, this also means better productivity and time management—people start work from wherever they are, without wasting 1–2 hours on daily travel.

Cost Savings: ₹2,000–₹5,000/month per team member.

6. No Office Maintenance or AMC Charges

Physical offices come with hidden recurring expenses like:

Facility maintenance

Equipment repairs

Annual maintenance contracts (AMC)

Cleaning staff

With a virtual office, these are non-existent. You don’t need to manage or maintain anything unless you use on-site facilities, and even then, it’s included in your hourly booking.

Cost Savings: ₹5,000–₹15,000/month.

7. Pay Only for What You Use

One of the best features of a virtual office is its à la carte pricing model.

Need a meeting room for 2 hours this week? Book it. No need to pay for full-day access. Need a temporary coworking desk? Opt for daily passes only.

This "use-as-you-go" system makes it perfect for:

Freelancers meeting clients occasionally

Startups pitching investors

Remote teams coordinating once a month

Cost Control: No wasted resources or underutilized space.

Real-Life Use Cases Where Virtual Offices Cut Costs

Let’s look at how different types of professionals and businesses benefit from a Virtual office in Bangalore:

1. Freelancers & Solopreneurs

A freelance designer or writer working from home can:

Get a professional address on their invoices

Meet clients at on-demand meeting rooms

Avoid listing their personal address on Google

All of this at a fraction of what renting an office would cost.

2. Startups and Bootstrapped Teams

Early-stage startups save crucial funds by:

Registering their business without renting space

Using the address for official documentation and GST

Scaling operations remotely and booking physical space only when necessary

This lets them reinvest savings into product development and marketing.

3. Outstation Businesses Expanding to Bangalore

A Delhi-based consultancy planning to serve Bangalore clients can:

Use the virtual address for a Bangalore GST number

Offer local credibility to clients

Avoid full-fledged branch expansion until demand justifies it

This allows geo-expansion without heavy financial risk.

Key Features to Look For in a Bangalore Virtual Office

When choosing a virtual office provider in Bangalore, ensure they offer:

✅ Prime location (Koramangala, MG Road, Whitefield, Indiranagar) ✅ GST registration support ✅ Mail handling & courier services ✅ Meeting room access ✅ Transparent pricing (no hidden charges) ✅ Easy contract and fast activation ✅ Optional upgrades like coworking desks or private cabins

Is a Virtual Office Right for You?

If you answer yes to any of these, a virtual office is a great fit:

You want to reduce office rent to under ₹2,000/month

Your business doesn’t require a full-time physical office

You operate remotely or travel often

You need a professional image without the overhead

You’re launching in Bangalore from another city

Final Thoughts

The idea that every business must maintain a physical office is becoming obsolete. As digital work culture expands, companies are shifting toward smarter, leaner operational models. A Virtual office in Bangalore provides all the advantages of a traditional office—professional address, legal compliance, and meeting space—without the burden of high fixed costs.

In 2025 and beyond, cost efficiency will define competitive advantage. Whether you're a startup on a shoestring budget or a growing company scaling across cities, a virtual office lets you cut costs while staying credible and operationally agile.

#VirtualOfficeInBangalore#StartupTips2025#RemoteWorkIndia#BusinessSavings#BangaloreStartups#LeanOperations

0 notes